Walter Industries doesn't hold much water on a value perspective

After selecting WLT from one of the email requests to review, I will not be adding Walter Industries (WLT) to my value portfolio mainly because of the high amount of debt in relation to the book value. My value scorecard only shows one passing mark in the dividend section with a yield of approximately 0.4% in 2005. In providing a growth assessment of the firm, WLT curently provides some upside opportunity to the current trading levels with the lowest P/S multiple across the industry comparative. This growth upside does have some risk associated with it driven by the P/S industry benchmark of 1.4x vs. WLT's 0.7x.

Company Overview

Description

Walter Industries, Inc., is a diversified company which operates in seven reportable segments: Mueller, Anvil, U.S. Pipe, Natural Resources, Homebuilding, Financing and Other. Through these operating segments, the Company offers a diversified line of products and services including water infrastructure and flow control products, coal, natural gas, home construction and mortgage financing, furnace and foundry coke and slag fiber. On December 3, 2003, the Company completed the sale of AIMCOR, previously a wholly-owned subsidiary of the Company, to Oxbow Carbon and Minerals LLC. The Company also completed the sale of JW Aluminum, previously a wholly-owned subsidiary of the Company, to Wellspring Capital Management LLC on December 5, 2003. As a result of the above sales, the results highlighted below have not been classified into discontinued operations.

5-Year Financial History

In the 5-year historical picture, Walter Industries had two major divestitures in December 2003 and two major acquisitions in October 2005. The 2002 – 2003 annual revenue and income impact is driven by the divestures. Excluding these one-time impacts, WLT has been showing some nice revenue growth along with going into a profitable position. On a trailing twelve months (TTM), I am anticipating a 78% annual increase in revenue to $3.2 Billion mainly driven by the recent Mueller and Anvil acquisitions completed on October 3rd, 2005. In the past 5 years years, Walter Industries has maintained operating expenses at historical levels in the face of the divestures and acquisition activity.

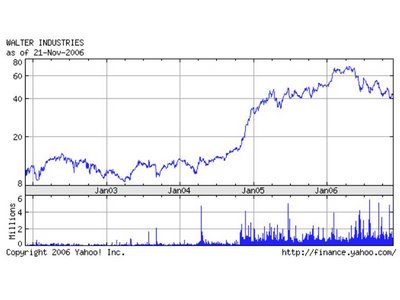

5-Year Stock Performance

If you had invested $10,000 in WLT stock on January 2nd, 2001, your stock would be worth $63,411 representing a +534% return or 36.0% annually. There were only 2 years that Walter Industries experienced negative price performance in 2002 and 2006 year to date.

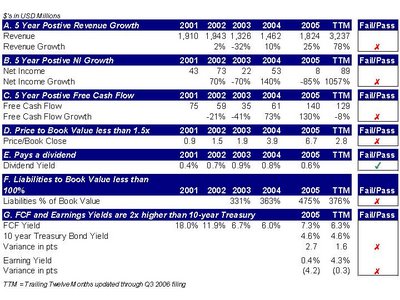

Value Assessment Scorecard

I use an 8 criteria selection grid to help me assess potential value in any equity assessment. These 8 criteria are mainly driven from my readings of Benjamin Graham. The security doesn’t have to pass all of the below criteria to be selected for my portfolio, the more the better. Some of the major items that I focus on are Price to Book ratio (Criteria D.) and the earnings and free cash flow yields metrics (Criteria G.).

The value scorecard illustrates WLT’s significant amount of debt compared to the current book value, currently at 3x on the last reported balance sheet as of Q3 2006. WLT’s price to book ratio has been steadily increasing from 2001-2005, with a correction on the TTM basis coming in at 2.8x. Slightly higher than what I am comfortable with. The company does provide FCF yield’s that are higher than the current 10-year note, but not 2x enough to provide me a safety margin in my investments.

Growth Assessment

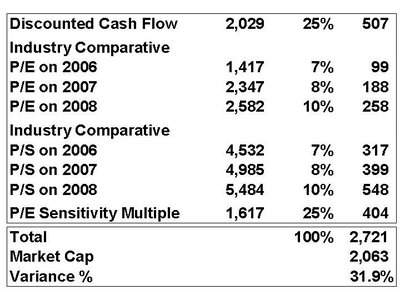

With my growth reviews of stock, I use a few different valuation techniques to surround my assumptions.

- 5 Year Discounted Cash Flow model with terminal value

- Industry Price to Earnings multiples

- Industry Price to Sales multiples

- Current Price to Earnings sensitivity

From a growth perspective, there is some potential upside to the current market cap value. This is mainly driven by the Price/Sales ratio that I am using from the Morningstar website at 1.4x. If I use a 0.7x price to sales ratio that the stock is currently trading at, the overall growth market cap is 2,089 or 1.2% upside opportunity to the current trading levels.

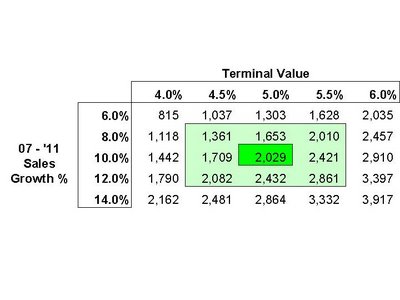

DCF Model

In my 5 year discounted cash flow model, I am assuming 10% sales growth with net income margin improving to 4.1% and the free cash flow % to revenue of 6.0%, compared to 2.8% and 4.0% on a TTM basis. With a corresponding 5% terminal value and 10% cost of capital, WLT’s value is worth around $2.0 Billion.

Industry P/E and P/S multiples

With the diversified portfolio of Walter Industries, I have elected to capture the Morningstar.com industry benchmarks for Price to Earnings of 15.9x and 1.4x respectively. As previously mentioned, the 1.4x Price to sales benchmark is creating a potential growth opportunity for WLT. When you hold the 0.7x of Price to Sales the current stock is trading at, the potential growth has disappeared.

Current P/E sensitivity

With the Morningstar.com benchmarks, you will notice the Walter Industries is currently trading at 48.7x to earnings per share with the industry trading at 15.9x. I have selected a P/E of 15.0 to capture the market cap sensitivity on project future earnings growth of 10%.

Sources:

Company Website

Edgar Online database

Yahoo Finance Website

Morningstar Website

4 comments:

Walter is a comany that is going through a host of changes over the next couple of months. The majority of the debt lies with two businesses: 1. Mueller Water and 2. the mortgage subisdiary. Current market cap is approx. $2.6 billion.

WLT plans to spinoff MWA in the next few weeks, taking the debt with it. Incidentally, the company has more than adequate cashflow to payoff the debt which comes due from 2010-14. The value of MWA.B shares that WLT holds is appoximately $1.3 billion.

The mortgage subsidiary has the majority of the remaining debt. As this is a mortgage finance company, the business raises money to lend to homebuyers of its Jim Walter Homes division. The debt is non-course to the parent WLT Industries.

The last remaining business is the natural resources division, which is basically the company's coal operations. WLT sells the majority of its coal for steel and iron production (met. coal), which allows it to command a premium over steam coal. It has sold the majority of its coal productions through 1H2007 at prices of around $100/ton, which is roughly down 5% from the average price it has received in 2006. It will conservatively do $225 million in EBITDA next year; comparable coal companies are trading around 6x 2007 EBITDA estimates. This puts a value of roughly $1.3 billion on the business. Granted, coal prices are very volatile (they have doubled over the past few years and could just as easier go down).

Adding up the pieces thus far:

$2.6 billion equity value

LESS MWA.B stock: $1.3b

PLUS Credity facility: $274 million

Less Cash: $247m

Equals equity value: $1.2billion

The assuming the coal division can retain a $90+price per ton for its coal sales, one can argue the coal division is worth $1.2 billion alone. This would mean you are getting the homebuilder and mortgage finance company for free.

The main basis of this article was that this is my personal analysis/screening criteria to decide if I should include WLT in my portfolio. With that said, the main drivers of my decision were #1. the debt levels (adjusted for the mortgage backed securities) as a % to book value were over 100% for multiple years, something that I am not comfortable with and #2 having the business completing many acquisitions and/or divestitures in the past, I can't get a handle on the historical normalized cash flow trends.

Now that Walter has completed the MWA spinoff, it might be interesting to revisit your analysis.

Walter industries sounds ok.

Post a Comment