HD/LOW Pair Trade

As the blood runs in the streets for the housing market, the current Home Depot (HD)/ Lowe's (LOW) pair trade offers your portfolio a hedged opportunity.

Before I get into the details, Exhibit 1. is a company overview comparison chart.

Exhibit 1.

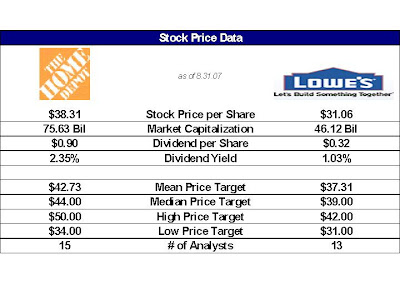

I would also like to include the latest analyst price targets for both companies, Exhibit 2. sourced from Yahoo Finance.

Exhibit 2.

The current stock price ratio for LOW/HD is 0.811 ($31.06/$38.31)

The current mean analyst price ratio target is 0.873 ($37.31/42.73)

In Exhibit 3, I have plotted the LOW/HD stock price ratio on a line chart. You will see that this ratio was just recently at the mean analyst price targets of 0.871, but has dropped to the 20-day average.

Exhibit 3.

In my opinion, I feel this is a good opportunity to enter in a pair trade up to the pair ratio reaches the mean analyst price target of 0.873 ratio.

Here are the details of the paper trade:

Buy 322 shares of LOW at $31.06 = 10,001

Sell Short 261 shares of HD at $38.31 = 9,999

This is a cash neutral hedge with the cash outflow on the LOW purchase and the inflow on the HD short sale.

If this trade is successful, it will provide a +4.1% return after commissions. I will calculate the annual percent rate when I exit the trade.

Disclosure: Author is neither long nor short HD or LOW.

1 comment:

Nice trade.

Post a Comment